What is Bookkeeping?

Bookkeeping refers to how companies keep track of their financial transactions, from the opening to closing of the firm. The type of documentation each company uses is dependent on the type of accounting system used by the business. Documentation can be in the form of receipts, invoices, purchase orders, or any other similar types of financial record.

Difference Between Accounting and Bookkeeping

While both accounting and bookkeeping involve financial data management, they serve different purposes.

Bookkeeping is primarily focused on recording financial transactions accurately. Accounting, on the other hand, involves interpreting and analysing financial data, creating financial statements, and offering insights for strategic decision-making.

At Swiftly, our accounting services go beyond bookkeeping by offering in-depth analysis, financial statement preparation, tax planning, and strategic advisory tailored to your business needs.

Why Businesses Trust Swiftly

Singapore Local Compliance Solutions

Our accountants handle IRAS, GST, and ACRA compliance so your business stays fully compliant with local regulations.

Industry-Specific Accounting Expertise

We optimise tax and reporting for your sector, helping you take advantage of industry-specific reliefs and incentives.

Flexible, Transaction-Based Pricing

Only pay for what you use. No hidden fees, just fair pricing that scales with your business.

Technology-First, Human-Based Approach

We combine Xero and QuickBooks automation with ISCA-certified accountants who deliver accurate, actionable financial insights.

Our Accounting Services

Professional bookkeeping and financial reporting tailored to your business. Choose the services that match your accounting and bookkeeping needs.

Regular Financial Reporting

Monthly, quarterly, or annual reports on your schedule. Stay in control of your finances with timely, accurate insights.

Complete Financial Statements

Profit & loss statements, balance sheets, cash flow analysis, and comprehensive debtors/creditors listings, everything you need to understand your business health.

Tax & GST Compliance

We handle GST submissions and tax computations, ensuring your business stays compliant with Singapore regulations.

Financial Diagnosis & Insights

Go beyond standard accounting. We uncover hidden patterns and opportunities to help you make smarter financial decisions.

Our Package Includes:

-

Accurate transaction recording and verification

-

Bank reconciliations

-

Customised reporting for your business structure

-

Financial statement preparation

Simple, Transparent Pricing at Swiftly

Pay only for what you use. No hidden fees, no fixed packages.

Your Compliance Roadmap

Compliance deadlines add up fast. Miss one, and penalties follow. Let us handle the boring paperwork and heavy lifting so you can focus 100% on growing your business.

| Compliance Item | What We Do | Frequency |

|---|---|---|

| Financial Statements | All Singapore companies must prepare annual financial statements in accordance with Singapore Financial Reporting Standards (SFRS). Swiftly handles the preparation so you stay compliant and audit-ready. | Monthly / Quarterly / Annual |

| GST Registration & Filing | Companies registered for Goods and Services Tax must submit quarterly returns to IRAS. Swiftly prepares the calculations, completes the filing, and ensures all submissions are made accurately and on time. | Quarterly, If Applicable |

| ACRA Annual Filing | Every company must file its Annual Return and financial report with ACRA each year to confirm key company details and financial status. Swiftly manages the full preparation and submission process to keep your records up to date. | Annually |

| Corporate Tax Filing | Each year, companies must file their income tax return with IRAS using Form C or Form C-S, typically by 30 November or 15 December. We calculate your tax position, prepare the necessary forms, and submit them on your behalf. | Annually |

| XBRL Filing | Certain companies are required by ACRA to file their financial statements in XBRL format for digital reporting. Swiftly handles the conversion and filing to meet all technical and compliance requirements. | Annually, If Required |

Who We Serve

Startups

Starting fresh? We’ll set up your books from day one, keep you compliant, and help you stay investor-ready without the usual admin headaches.

SMEs & Growing Teams

Scaling up? Get reliable payroll, reporting, and tax support so you can focus fully on growing your business.

Freelancers

Working solo doesn’t mean doing it alone. We’ll handle your bookkeeping, taxes, and GST while you focus on your craft.

Tech Startups & E-Commerce

Running a fast-moving business? We understand complex revenue models, global payments, and investor expectations.

Family & Owner-Operator Businesses

Keep your personal and business finances clean, compliant, and structured for tax efficiency. We’ll simplify the entire process for you.

Established Companies

Let your compliance run on autopilot. Swiftly manages your filings, deadlines, and reporting with precision so your operations stay smooth and your team stays focused.

Why Outsource Your Accounting

Save Time & Focus on Growth

Let us handle the numbers so you can focus on the ideas, clients, and projects you love.

Cut Costs, Keep Quality

Get expert-level accounting without the overhead of a full-time hire. Scale your support as your business grows.

Stay Compliant, Stress-Free

Never worry about missed deadlines or penalties. We handle filings and keep your business on track.

Make Smarter Decisions

With clear, up-to-date financial insights, you can plan, forecast, and grow with confidence.

5star Reviews on

Meet Our Singapore Accountants

Meet our team of certified accountants, experienced in Singapore’s regulatory landscape to keep your business compliant and efficient.

Zhong Kent

Accounts Manager

Zhong Kent leads Swiftly’s technical accounting operations, bringing deep expertise from his tenure at KPMG in Singapore and Malaysia. He has managed complex audit engagements across manufacturing, shipping, and pharmaceutical sectors, with strong command of IFRS, SFRS, and US GAAP. His experience includes US IPO audit support, group consolidation, and quality assurance under ISQM 1 standards. Fluent in English and Mandarin, he ensures every Swiftly engagement meets rigorous standards of accuracy and regulatory compliance.

Suzan

Senior Accounts Executive

Suzan brings extensive audit and accounting expertise to lead full-set account management and financial review at Swiftly. She specialises in providing robust statutory audit support, thorough compliance assessments, and precise transaction accuracy reviews across multiple platforms. Her 6+ years of experience ensure meticulous attention to detail, maintaining the highest levels of Singapore regulatory compliance for your business.

Yoke Tein

Accounts Executive

The Enterprise World is a leading global business publication known for profiling companies driving industry change. Swiftly's feature in the 2025 edition highlights our innovative approach to company incorporation and corporate secretarial services, showing how we help startups and enterprises modernize their business presence in Singapore.

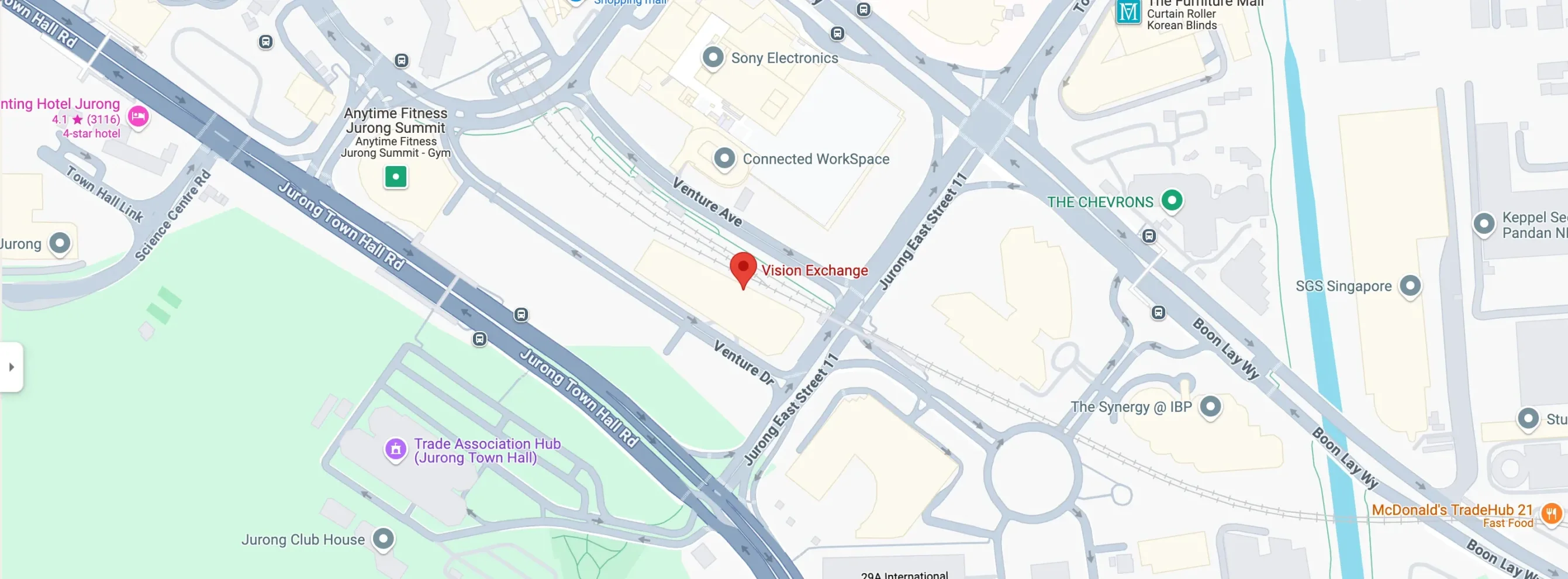

Contact Us

Here we are

Within Singapore’s 2nd Central Business District.

Get in Touch!

Venture Dr

2 Venture Dr, #19-21 VISION EXCHANGE,

Singapore 608526

*This branch requires scheduling appointments for visits.

Suntec

7 Temasek Boulevard, #12-07 Suntec Tower

One,

Singapore 038987

*This branch will not entertain walk ins.

Let's Talk About

Frequently Asked Questions

Accounting

Singapore has its own Accouting standards called Singapore Financial Reporting Standards (SFRS). It’s similar to IFRS and it’s accrual-based accounting. This means transactions are recognised when they take place and not when the money is paid. Outsourced accounting services in Singapore must comply with SFRS requirements.

For you to produce accurate accounting statements, you will have to be kept updated with the latest changes in the Singapore accounting laws. Should you have the relevant skillset and time required to prepare the accounts according to the government's standards, you are able to do so. However, it is far better to let the professionals handle accounting and auditing tasks. This will free you to concentrate on the core functions of your business.

Professional accountants at Swiftly make sure that they are updated with the changes in requirements. This ensures that the prepared accounts are up to the required standards.Swiftly can also advice you on tax issues related to your business.

You will have to choose a trustworthy Singapore accounting service provider. And no one better than Swiftly! This helps you save both money and time, of which would have been spent selecting and training accounting professionals for your company.

Professionals at Swiftly submit accurate and timely reports for you. We use the latest accounting software to process your data securely. With our experience, handling your compliance requirements never gets easier.

Yes, it is possible to transfer money out of Singapore. Singapore has signed double-taxation treaties with more than 50 trading partners. These help businesses and individuals in avoiding double taxation on their cross-border income.

The destination country may apply tax when your money arrives in its jurisdiction. Check with a tax consultant to know the latest requirements.

Your company must maintain proper records of its financial transactions and retain the source documents, accounting records and schedules, bank statements and any other records of transactions connected with your business for 5 years from the relevant Year of Assessment (YA). More information can be found in here.

Goods and Services Tax (GST)

The Government and Services Tax or GST is a consumption tax that is level in nearly all of the goods and services in Singapore. This is similar to the Value Added Tax or VAT in many countries. More information can be found in this link

The company is mandated to register for GST if its annual turnover surpasses SGD 1 million during the previous year or if the company’s expected annual turnover in the coming year surpasses SGD 1 million.

Financial Statement

You need to prepare financial statements simply because:

1. It is required by the law to do so. The Companies Act states in S201 that the directors of the company need to prepare the accounts that complies with the “Accounting Standards”. Accounting Standards is interpreted in the Act as “made or formulated by the Accounting Standards Council under Part III of the Accounting Standards Act 2007”. Therefore, the Accounts mentioned in the Act means Accounts prepared in accordance to the Financial Reporting Standards of Singapore, that is, the Financial Statements.

2. IRAS requires you to prepare financial statements and tax computation for submission of corporate tax every year. In recent years, you do not need to submit your financial statements to IRAS if your Company is eligible to file for Form C-S filing. However IRAS has explicitly mentioned that you will still be required to continue to maintain your accounting records and tax computation even if you need not submit them together with the Form C-S.

3. If your company is not exempt, or is exempt but insolvent, you will need to submit your financial statements to ACRA during the Annual Return filing period.

4. Financial statements are in essence, a report card of the financial performance of the company and the information presented will be extremely valuable to the owners of the Company, as well as directors of the company, when assessing the future plans of the Company.

5. Whenever you intend to sell shares of your company to another investor, stamp duties need to be paid and a part of the stamp duty computation requires the use of financial statements to derive the net asset value of the Company.

6. If you have taken up business or property loan, a copy of your financial statements may be required in your refinancing procedures.

Preparation of Financial Statement includes:

1. Reviewing the accounts provided to assess the necessary adjustments needed

2. Reviewing and classification of accounts into respective classes of accounts

3. Notes to accounts preparation - required for financial report

4. FS disclosure - required for financial report

5. Preparation of full final financial report

Even though you are not required to file the financial statements, you will still be required to prepare it.

Under sections 201(2) and 201(5) of the Companies Act (the "Act"), directors are responsible to present and lay before the company, at its annual general meeting, financial statements that:

- comply with Accounting Standards1 issued by the Accounting Standards Council; and

- give a true and fair view of the financial position and performance of the company.

In addition, directors of a company incorporated in Singapore are responsible to maintain a system of internal accounting controls and keep proper accounting and other records that will enable the preparation of true and fair financial statements under sections 199(2A) and 199(1) of the Act, respectively.

Preparing a company’s financial statement is a complex process that only qualified accountants should undertake. If you are not familiar with the accounting and financial reporting standards in Singapore, it is best to engage the services of an accountant, like Swiftly, to ensure compliance with ACRA & IRAS requirements.

Corporate Income Tax

Singapore has a single-tier territorial-based flat-rate corporate income tax system.

Corporate Income Tax is assessed on a preceding year basis in Singapore. Singapore’s Corporate Income Tax is at a flat rate of 17% of its chargeable income.

Chargeable income refers to your company's taxable income (after deducting tax-allowable expenses) for a Year of Assessment (YA).

Learn more about taxable and non-taxable income and business expense.

The Estimated Chargeable Income or ECI is the company’s estimated amount of taxable income for an accounting period. The amount should exclude tax allowable expenses incurred during the Year of Assessment (YA).

The tax exemption scheme for new start-up companies and partial tax exemption scheme for companies are tax reliefs available to reduce companies’ tax bills.

The tax exemptions for qualifying companies for their first 3 consecutive YAs are as follows:

- 75% exemption on the first $100,000 of normal chargeable income*; and

- A further 50% exemption on the next $100,000 of normal chargeable income*.

* Normal chargeable income refers to income to be taxed at the prevailing Corporate Income Tax rate of 17%.

Your company is eligible for the tax exemption scheme for new companies for its first 3 consecutive YAs if it meets all the qualifying conditions.

Electronic filing of Form C-S/C is compulsory for all companies.

Corporate tax is reported based on financial statements of the preceding financial year.

The filing deadline for corporate tax return (Form C-S/C) is on the 30th November of every year.

Example: Corporate Tax Return for Year of Assessment (YA) 2021 should be completed based on financial statement for the year ended 2020. The deadline for filing of the Corporate Tax Return (Form C-S/C) for the Year of Assessment (YA) 2021 is 30 Nov 2021.

There are mandatory requirements to complete two corporate tax filings to the IRAS annually.

They are the submission of Estimated Chargeable Income (ECI) and Corporate Tax Return (Form C/C-S).

For ECI submission, it should be submitted to the IRAS within three months of the Company's financial year end.

For Form C/C-S submission, it should be completed by 30th November of the year.

Waiver of ECI and/or Form C/C-S submission can be applicable if qualifying conditions are met.

eXtensible Business Reporting Language (XBRL)

XBRL is a standardised format of financial reporting for almost all businesses in Singapore. Depending on your company’s revenue and assets, you can submit your financial reports in Simplified XBRL format instead of the Full XBRL format.

The XBRL is the international format for financial reporting and the filing must be completed on ACRA’s portal BizFinx.

All companies incorporated in Singapore which are either limited or unlimited by shares (except exempted companies) are required to file their full set of financial statements in XBRL format according to the recent guidelines released by ACRA (Accounting and Corporate Regulatory Authority) Singapore June 2013.

Financial Year End

The financial year end (FYE) of Singapore is the end of the fiscal accounting period of a company which is usually up to 12 months.

Annual Obligations of a Pte Ltd Company

- Estimated Chargeable Income (ECI) – within 3 months from finanical year end

- Annual General Meeting (AGM) – by the 6th month from finanical year end

- Submission of Annual Return (AR) – by the 7th month from finanical year end

- Corporate Income Tax Return (Form C-S/ C) – by 30th November of the preceding year

1. Preparation of Management Accounts

a) Trial Balance

b) Balance Sheet

c) Profit & Loss

d) Detailed General Ledger Listing

2. Filing of Estimated Chargeable Income (ECI)

3. Preparation of Tax Computation

4. Preparation of Financial Statements in accordance to the Singapore Financial Reporting Standards

5. Annual General Meeting (AGM)

6. Filing of Annual Return with ACRA

7. Filing of Annual Tax Return with IRAS

The company is considered as dormant as long as the company meets all the criteria below:

a) Dormant company according to IRAS

A company that does not have any revenue or income during a given financial period is considered Dormant by IRAS even though it may have booked or incurred expenses.

b) Dormant company according to ACRA

ACRA defines a company as dormant during a period in which no accounting transaction occurs.

Transactions that will not affect the dormant status of the company:

- The appointment of a secretary of a company;

- The appointment of an auditor;

- The maintenance of a registered office;

- The keeping of registers and books;

- The payment of fees to the Registrar or an amount of any fine or default penalty paid to ACRA; and

- The taking of shares in the company by a subscriber to the constitution in pursuance of an undertaking in the constitution.

In addition to the points we have listed above as long as the payment or receipt is not exceeding the nominal sum of SGD 5,000, the company can be classified as dormant.

Other Services

Nominee Director

Fully compliant Nominee Director with ethical profiles. No security deposits required.

Sign Up